All the top property management companies are using virtual assistants (VAs) to cut costs and get ahead. Before you hire your own team of VAs, it’s important to understand virtual assistant costs in property management. This will save you from a lot of trouble later on.

In this article, we’ll cover salaries, explore different hiring routes, and share some best practices.

How Much Does a Virtual Assistant Cost to Hire?

There are 4 main ways in which you can hire a VA, and they all come with different upfront and long-term costs. You can either have your VA onboard full time, or have a middleman between you that can deal with connecting you and handling the payments.

How much time and money you spend while hiring your VA depends on you. More money doesn’t always guarantee the best results, so it’s best to explore your options:

1. Job Boards

Job boards like Indeed, Upwork, VPM Solutions, and Outsourcely, Hubstaff, along with similar local platforms, provide a straightforward hiring process for property managers. By simply signing up, users get instant access to a pool of remote candidates, which makes interviewing and hiring very simple.

Job boards usually earn by taking a fixed amount from their salary. This additional cost is pushed onto you, making VAs from job boards more expensive in the long run.

Payments are made on the job board itself in some cases, while in others, you’ll need to pay for posting jobs after which you’ll be able to deal directly with your VA once you’ve hired them..

Estimated Cost:

- Basic Job Search: Free

- Long-term Cost: Increased salary expenditure due to job board fees. Upwork and VPM Solutions both charge a 10% fee, while other job boards can charge more.

- Hubstaff and Outsourcely are free for a limited number of job postings. However, they don’t have an inbuilt payment structure.

3. Traditional Staffing Agencies

Staffing agencies like Virtual Latinos and Anequim can streamline the hiring process by presenting pre-screened candidates for property management, which can be especially quick and helpful. They also handpick VAs based on your requirements.

While Virtual Latinos doesn’t have recruitment fees, staffing agencies typically charge a fee of 15% to 30% of the VA’s annual salary, representing a trade-off between convenience and cost.

You’ll usually pay the staffing agency, which will in turn pay your VA.

Estimated Cost:

- Agency Fee: 15% – 30% of the VA’s annual salary

- VA salary: Starting at $8/hr

- Recruitment costs: Free

4. DIY Route

The DIY route, leveraging free or low-cost platforms, requires a more hands-on approach. It may be more time-consuming but can also be a cost-effective way to find a suitable candidate, offering flexibility and control.

The downside is that, for small companies, the time spent looking for the right VA can be very costly (especially if you don’t have a lot of experience).

Estimated Cost:

- Job Posting on Freelance Sites: $0 – $50

- Time Investment: Variable, considering the value of your time. It could take 3-10 weeks to find the right VA, depending on how experienced you want them.

Costs aren’t the only consideration when hiring a VA. There’s a lot of important information you should know before you set up your remote team.

Note: Depending on the role you’re hiring for, a full-time employee isn’t always the best option. In such cases, hiring a freelance contractor based on an hourly compensation is the way to go. You can hire them via job boards or look for them in your network.

Key Takeaway

Each method, whether it’s leveraging job boards, partnering with staffing agencies, direct hiring, or taking the DIY route, offers its own set of advantages. Balancing time, cost, and control is key in selecting the method that aligns best with your needs and preferences.

Virtual Assistant Costs By Experience

A good tip to keep in mind is that an entry-level VA can end up costing you more money in the long-run, even though experienced VAs have higher salary expectations and hiring costs.

However, the amount of experience a VA has also determines the type of role they are qualified for. A virtual administrative assistant salary will be lower than what you’d normally pay a marketing manager with property management experience.

BetterWho, for example, offers a Tier-3 remote team member program which revolves around highly specialized positions. It’s best for advanced roles like marketing managers, process directors, and property managers. Specialized professionals like these with experience in and knowledge of the property management industry are difficult to find through a DIY approach.

In contrast, less experienced VAs may require specialized training (unless you work with our RTM Direct program, in which every VA receives property management training free of cost). BetterWho has a training program that brings entry-level hires up to speed so they can hit the ground running and be profitable from day-1.

The average salaries for property management VAs:

Experience Level | Salary Consideration | Description |

Entry-Level | Low $5.5-$6.25 | Candidates have limited experience, often handling less complex tasks. Acquisition costs and salaries are typically lower, reflecting the learning and development phase of their roles. They are typically suited for customer service and leasing specialist roles. |

Mid-Level | Medium $6.25-$8 | Individuals possess a moderate level of experience and potentially specialized skills. The acquisition cost and salary are balanced, reflecting an increased ability to handle more complex responsibilities. |

Highly Experienced | High $15-$30 | Highly experienced individuals have extensive knowledge and specialized skills. They usually command the highest acquisition costs and salaries due to their ability to provide strategic value and leadership. |

Virtual Assistant Costs By Location

It’s not always possible to determine the average virtual assistant salary from any given location. Factors like their exposure to the property management industry and skill-level play a major factor in their salary expectations.

For example, the Philippines’ virtual assistant costs are usually on the lower end, but in our experience, highly skilled VAs tend to charge more regardless of their location.

But, different locations have varying costs of living, from which we can draw a rough estimate for virtual assistant services rates from these general locations:

Region | Average Cost Per Hour |

Latin America | $10 – $30 |

Africa | $5 – $15 |

Asia | $5 – $15 |

With the rise in remote hirings, VAs have started anticipating more payment than what was previously considered the industry norm.

However, it’s still highly beneficial to hire remotely. On average, the executive virtual assistant salary in India (and other countries in Asia) will almost certainly be lower than what professionals in the US will charge.

Flat Salaries vs. Hourly Pay

Deciding between hourly and fixed salary payments hinges on your company’s needs and the nature of the employee’s role. There are no fixed rules here. In our experience, property management companies start off with new remote team members on an hourly pay rate, and later on switch to flat fee salaries after some time and based on merits.

In contrast, roles like web developers and marketers, where work demand can vary, benefit more from an hourly structure. This way, you can pay for work as needed, optimizing resources and managing costs effectively.

Payment Aspect | Fixed Salary | Hourly Pay |

Pros |

|

|

Cons |

|

|

How To Pay Your Virtual Assistant

When you hire a VA through a job board or a traditional staffing agency, you do not need to worry about how to pay them, as the third party will handle their salaries; you just pay the third party. However, when you hire directly with a specialized recruiting agency, or you go the DIY route, it’s in your responsibility to make sure you pay your new remote team member.

Depending on the geographical location of the assistants and the currency preferences, there are multiple methods of payment and considerations based on the region of the globe:

Methods of Payment

- Wise: Suitable for international transfers, offering competitive exchange rates. Some countries don’t allow payments via Business Accounts, so beware of that.

- Remitly: Useful for fast international transfers, with varied delivery options.

- Veem: A good option for business transactions, facilitating international payments.

- Binance: Ideal for those preferring cryptocurrency transactions. Payments sent through USDT are quick and easy.

- Xoom: A service of PayPal, efficient for quick international transfers, especially in countries where PayPal is not operational.

- Upwork: Direct contracts on Upwork are great for VAs who have an account on the platform.

Currency Consideration

- Pay in Local Currency: This can be preferred by assistants as it offers them stability against currency fluctuations and avoids conversion fees.

- Pay in USD: This might be convenient for you, especially if the majority of your business is conducted in USD, and is also widely accepted. It’s also a great option for VAs who live in countries with high inflation rates.

Employment Structure

- Employer of Record (EoR): An EoR can manage employment compliance, payroll, and benefits in the assistant’s home country, reducing your administrative burden but it can be more costly. The EoR essentially becomes the legal employer of the VA on your behalf. BetterWho lets you work with an EoR from the country of your Va.

- It’s important to note that EoRs charge a fee for their services, which is typically in the range of $200-$500.

- Also, going the EoR route means you will have to follow all the regulations of the country where your VA resides. This includes paid time off, pension funds.

- The high fees, combined with these restrictions, makes most PM companies avoid working with EoRs. Hiring a VA directly is far cheaper and more efficient.

- Contractor Work: Hiring assistants as contractors can simplify your administrative processes but can be less attractive to potential candidates seeking long-term employment.

The optimal payment method, currency, and employment structure depend largely on your needs, the preferences of your virtual assistants, and the legal and economic environments in both your location and that of your assistants, so make sure you have a discussion with your new team member to establish mutual expectations.

Balancing convenience, cost-efficiency, and compliance is key in determining the most suitable approach to remunerating virtual assistants.

Tax Considerations When Paying Your Property Management VA

Individual Fiscal Status

The taxation of your virtual assistant may vary greatly depending on whether they opt to work as self-employed, form an LLC, or choose another business structure. Each status comes with its unique tax implications and obligations.

- In some countries, freelancers are typically required to declare their revenue, and they are subject to the tax laws and rates of their respective countries. Tax rates and regulations can differ significantly from one country to another.

- Freelancers need to manage their tax payments, which include income tax, and may include, depending on the country, additional value-added tax (VAT), social security, pension funds, and medical insurance compulsory contributions.

- It is imperative for virtual assistants to understand and comply with the tax laws applicable to their business structure and country of residence.

- Similarly, you should strive to be knowledgeable about the tax regulations relevant for your virtual assistant or virtual assistants from different regions, to avoid any legal complications.

- When employing foreign VAs, you should fill out a Form W-8BEN to declare them as foreign independent contractors. It doesn’t need to be submitted to the IRS, but you should have it with you if it’s ever needed.

Disclaimer: This is not tax or financial advice, but rather information that we’ve found to be useful in our experience.

When To Pay Your Property Management VA

When determining the payment schedule, consider what you’re used to as a business owner and what is feasible and preferable for your virtual assistant. Payment frequencies can include weekly, bi-weekly, or monthly schedules.

Flat Fee Salary vs. Hourly Pay

- Flat Fee Salary: Typically, a monthly payment schedule suits salaried virtual assistants best, aligning with the conventional salary disbursement structures.

- Hourly Pay: For those paid by the hour, a more frequent payment schedule like weekly or bi-weekly may be more appropriate, allowing assistants to maintain regular cash flow.

Depending on how your organization is structured, you could outsource your payment scheduling and implementation so you can focus purely on the property management aspect of your business.

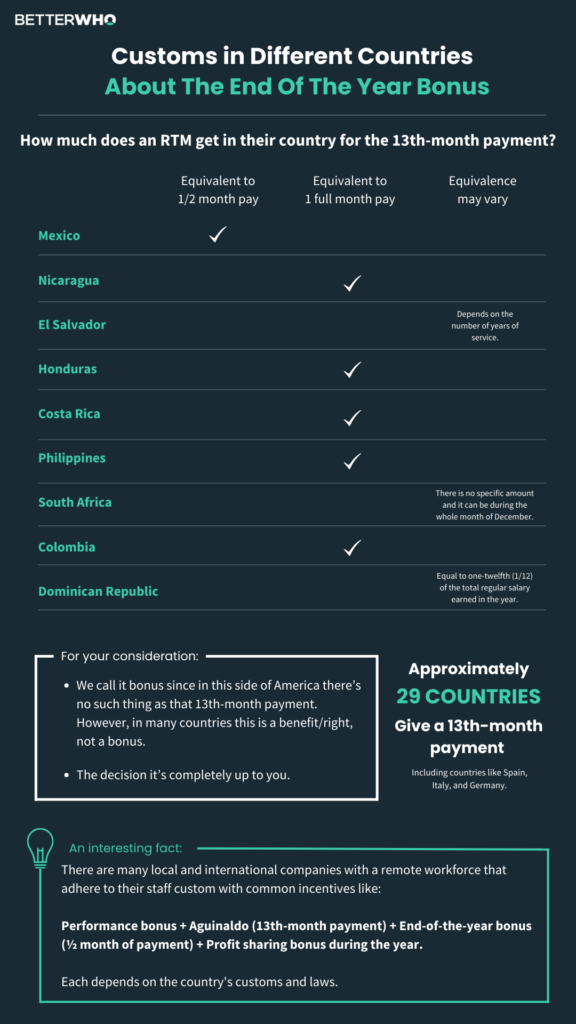

13th-month Payments for VAs

In many countries, like the Philippines, a 13th-month payment is expected by employees. It is a form of a bonus, typically given in December, and is usually equivalent to one month’s salary.

While you’re not legally bound to pay them an extra amount at the end of the year, doing so is worth the goodwill, loyalty, and strong team bonding that will result from it.

Our Suggestions For Best Practices

Have the conversation with your team members

If you already have a monthly incentive program, is it necessary to give an end-of-the-year bonus? – Ask them what they would prefer while setting the right expectations. You may be surprised about their preferences, it’s a common practice but not expected or preferred by everyone.

Include it in your offer letter or agreement

There is nothing better than having the game rules clear from the very beginning. This way you’ll avoid misunderstandings in the future.

It’s a payment for them, and a bonus for us because it’s a law in their countries

We may be used to seeing it as a bonus or extra pay for the nature of our system. It just doesn’t exist in our country. However, it’s a very important and expected custom in most of the countries our RTMs work from. In this case, the right term is “payment or 13th salary” for them.

You can prorate the bonus

If your RTM has been with you only for a few months, you can prorate the equivalent of their time working for an end-of-the-year bonus (this varies from country to country).

Alternatives to the 13th-month pay can be:

- Offering a higher wage of payment instead of a one-time bonus at the end of the year.

- Giving a monthly performance bonus which is also a custom in most countries, particularly in sales or customer service positions.

- Another common practice is dividing the end-of-the-year bonus into a monthly/quarterly/twice-a-year performance bonus.

Planning your raise or reward structure ahead of time will save you from future inconveniences or misunderstandings. Knowing about this topic will also help ensure that future raises or bonuses comply with the right expectations and fit your budget.

Make sure to track raises and keep track of your remote team member’s work performance for easy reference in the future.

Salary Increases For Property Management VAs

It’s important to figure out when and how to give pay raises and bonuses to keep teams, including virtual assistants, motivated.

This can be tough, especially for remote workers, but setting clear, fair guidelines helps maintain productivity and encourages ongoing growth and success within the organization.

How to Know That Your VA Should Get a Pay Raise

Have a personalized 40-45 minute meeting weekly or biweekly with your VA just to check in and exchange feedback.

These meetings help monitor performance and set clear expectations, aiding in quarterly reviews. While annual raises are expected in the US, these regular check-ins and quarterly reviews will guide you in determining the right time for adjustments for VAs.

What to Evaluate When Giving Pay Raises

Every position has different indicators regarding pay raises.

For instance, Maintenance Coordination might focus on KPIs like tenant satisfaction or timely work order completions, while Leasing might look at weekly client reviews or response times.

After establishing appropriate KPIs and goals, consider overall performance—additional duties, responsibilities, challenges, and their management—to make informed decisions.

We have a resource for the 100 KPIs (that every property manager should know of) on our website. Click here to download it for free and get new ideas on what you need to keep an eye on!

What to Look Out For

In many cultures worldwide, employees often find it difficult to ask for a raise, as it is not a customary practice (in fact, in some it’s even considered inappropriate). Having open communication with your VAs regarding this matter can save you from awkward situations later on.

However, as mentioned before, VAs around the world have come to expect higher compensation packages in recent years and some may even expect a raise after 3 months of employment.

When awarding pay raises, negotiation is key, as offering an increase that falls below expectations can be more detrimental than not giving one at all. This can lead to the VA feeling like they have no future in the company.

Bonuses For Property Management VAs

There are types of VAs who can be highly incentivized to perform well based on their reward structure. For example, BDMs and sales managers could be offered a bonus for every contract they close.

Determining a reasonable bonus for your VA can be variable and depends on several factors such as the value of the contract, the region the VA is located in, and the company’s financial standing.

However, a common practice is to award a percentage of the contract value or a flat rate per contract signed.

Here are a few considerations:

- Percentage of Contract Value: Offering a percentage (e.g., 1-5%) of the contract value as a bonus can be motivating, especially for high-value contracts.

- Flat Rate Bonus: A fixed amount per closed contract can be simpler to manage and can offer more predictability. Depending on their base salary, you could pay you BDMs a $25-$50 commission for every new door they add to your portfolio.

- Combination: Some companies use a combination of a flat rate and a percentage to balance predictability and incentivization.

Vacations For Property Management VAs

- Paid Vacation Days: Many cultures have paid vacation days. It’s important to clarify this and set the right expectations from the start of your relationship with the employee.

- U.S. National Holidays: Decide early on whether employees should work on these days or not and if they’ll receive compensation. Make sure to communicate this clearly.

- International Holidays: Different countries have different holidays. Establish in the beginning whether your employee is expected to work during those days and explain the payment structure for these days explicitly. Clear communication from the get-go will help avoid misunderstandings and ensure a smoother working relationship.

Every company has their own strategy for navigating holidays, but it’s usually a good idea to have your VAs take a day off during their regional holidays and work during US holidays.

In Summary

When exploring virtual assistant costs in property management, it’s really important to be clear from the start.

Choose a pay structure, whether it’s a set salary or an hourly rate, that works for both you and your VA, and keep in mind that where your VA is located can change salary expectations and holiday requirements.

Make sure to talk about bonuses, holidays, and potential raises early on to avoid any future mix-ups. In short, aim for clear, fair agreements and remember to respect your VA’s cultural norms and expectations for a successful working relationship.